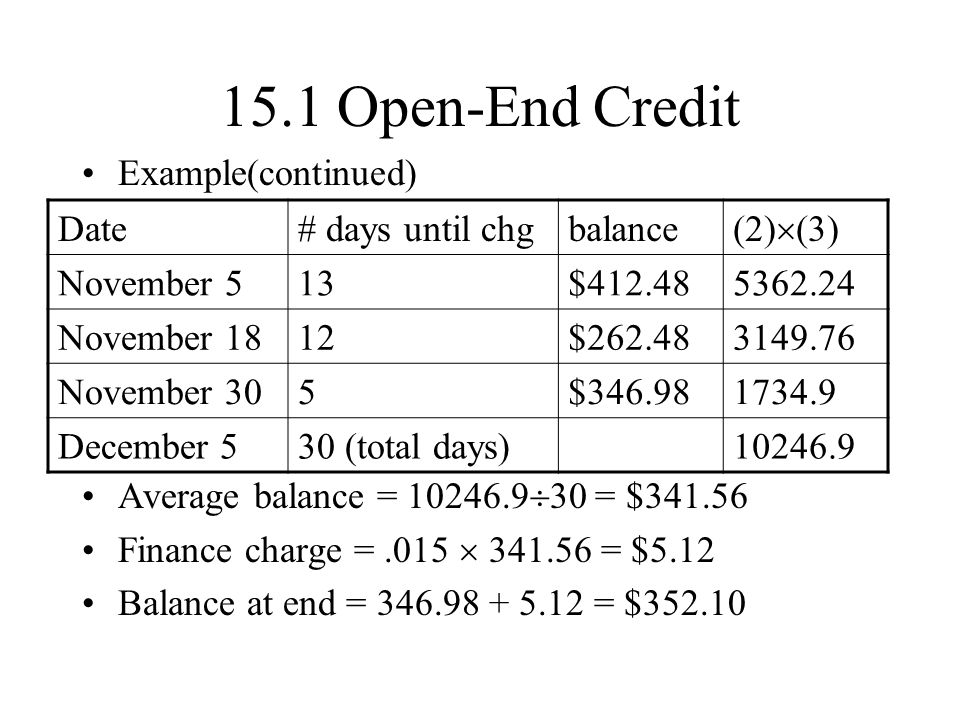

revolving open end credit example

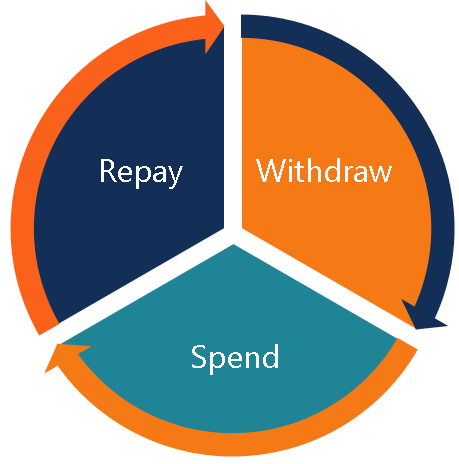

With open-end or revolving credit loans are made on a continuous basis as you purchase items and you are billed periodically to make at least partial payment. The terms can change.

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Open-end credit also called revolving credit can be defined as a line of credit that gives the borrower a certain limit of credit and the ability to frequently borrow as little or as.

. With revolving credit you can make a minimum payment and carry or revolve the rest of your debt from one month or billing period to the next. It comes with an annual. Revolving charge agreements on the other hand are often formed in connection with the usage of a credit card.

This type of credit contains elements of both installment and revolving credit. There are three common examples of revolving. Corporate Finance Institute.

Most department store charge accounts and. In the consumer market home equity loans are an example of an open-end credit which allows homeowners to access funds based on the level of equity in the homes. Open-end credit on the other hand is revolving credit that allows you to continually access money as you make payments and only pay interest on what you use.

Ad Business Line Of Credit Powered by American Express with Kabbage. View Test Prep - Open End Credit examples from MATH 140 at Colorado Technical University. Get Started Now Help Grow Your Business.

The borrower is able. Give Your Business the Boost It Needs to Thrive. With open credit the amount due is usually different each.

A credit card is a common example of revolving credit. At the same time you reduce the amount of. When you carry a balance on a revolving account youll likely have to pay interest.

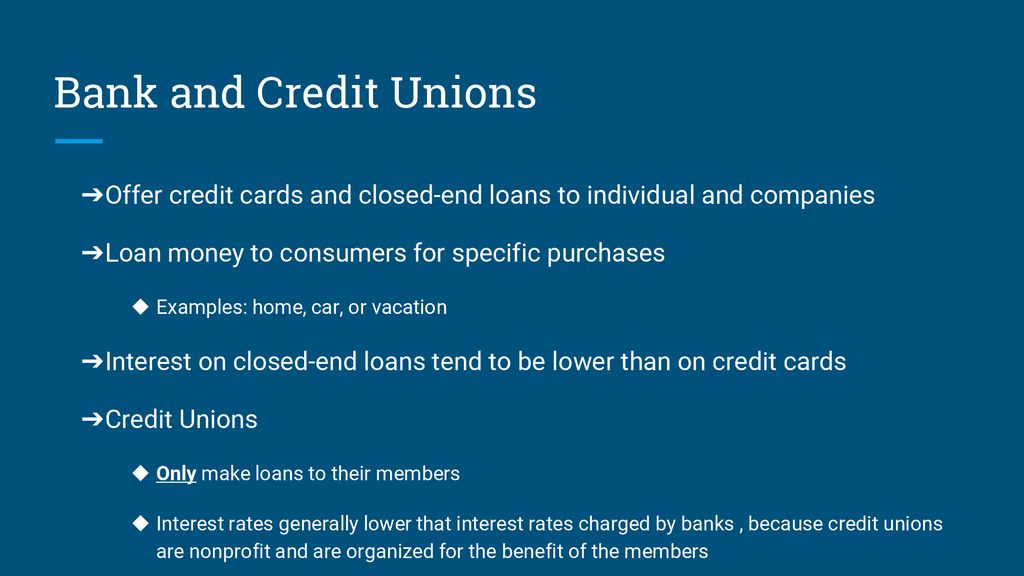

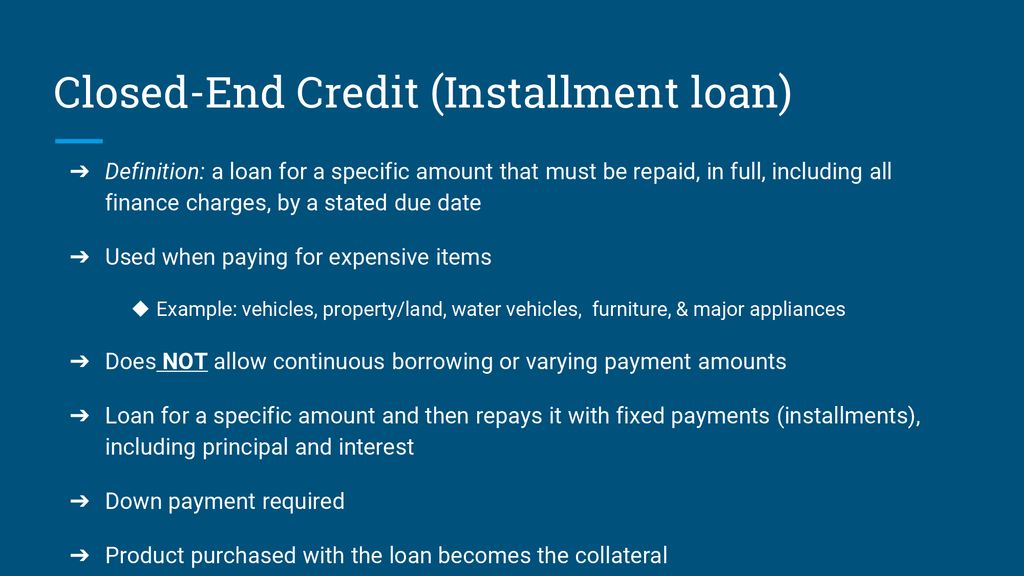

Credit A contract in which a borrower receives something of value now and agrees to repay the loan with interest over time. Open end credit is also known as a revolving line of credit and is arranged as a pre-approved amount of credit with no set end date or expiration date. Ad Compare Features and Loan Amount Ranges to Choose the Right Line of Credit For Your Biz.

Revolving open-end credit typically does not specify a maximum amount that can be borrowed. When you carry a balance on a revolving account youll likely have to pay interest. The 3 main types of credit are revolving credit installment and open credit.

Example of Open-End Credit. Unlike a traditional loan revolving credit is a set amount of credit you can borrow against time and time again. Credit enables people to purchase goods or services using borrowed money.

An open-end loan also sometimes referred to as open-end credit is a form of borrowing that can be used up to a certain limit before it must be repaid. CREDIT TYPE 3. In order to have.

For a revolving line of credit also called open-end credit the customer makes purchases against the credit up to a limit set by the lender. If you have a revolving credit limit of1000 for example you can choose to. A revolving line of credit is a preapproved loan or credit line that lets consumers and businesses borrow and repay money on a regular basis.

To better understand open-end credit it helps to know what closed-end credit means. Line of Credit or LOC An arrangement. Business Line of Credit.

With revolving credit you can make a minimum payment and carry or revolve the rest of your debt from one month or billing period to the next. How Revolving Credit Works. Find the Right Lender for Your Needs Now.

Revolving credit allows a borrower to spend the money they. Credit cards are an example of revolving open-end credit. Open ended vs.

The credit account can be used repeatedly provided your account stays open and all minimum payments are met. By contrast a revolving credit facility refers to a line of credit between your business and the bank. Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back.

Open End Credit This is a type of credit loan paid on installments in which the total amount. With revolving credit you can use the line of credit repeatedlyup to a certain credit limitfor as long as the account is open. Three types of revolving credit accounts.

Installment credit gives borrowers a lump sum and fixed scheduled payments are made until the loan is paid in full. When you use a portion of your revolving line of credit you increase your balance on the account. Three types of revolving credit accounts.

With a closed-end loan you borrow a specific amount of money for a set period of.

Understanding Different Types Of Credit Nextadvisor With Time

Lesson 16 2 Types Sources Of Credit Ppt Download

Lesson 16 2 Types Sources Of Credit Ppt Download

Lesson 16 2 Types Sources Of Credit Ppt Download

Appendix G To Part 1026 Open End Model Forms And Clauses Consumer Financial Protection Bureau

Chapter Open Ended Credit An Agreement To Lend The Borrower An Amount Up To A Stated Limit And To Allow Borrowing Up To That Limit Again Whenever Ppt Download

Fake Credit Report Template Best Of Fake Credit Report Template Doctors Note Template Report Template Business Template

Types Of Credit Definitions Examples Questions

13 1 Compound Interest Simple Interest Interest Is Paid Only On The Principal Compound Interest Interest Is Paid On Both Principal And Interest Compounded Ppt Video Online Download

What Is Open End Credit Experian

What Are Three Types Of Consumer Credit

What Are Three Types Of Consumer Credit

How Revolving Credit Works Howstuffworks

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

:max_bytes(150000):strip_icc()/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Credit Debt Managing Both Wisely

Personal Finance Chapter 6 Powerpoint

What Is Open End Credit How It Works Examples Pros And Cons Cash 1 Blog News