rhode island tax table 2021

The income tax is progressive tax with rates ranging from 375 up to. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income.

Rhode Island Estate Tax Everything You Need To Know Smartasset

The Rhode Island State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Rhode Island State Tax CalculatorWe also.

. The Rhode Island State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Rhode Island State Tax. He States motor fuel tax is allocated to the T. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022.

The States motor fuel tax is dedicated to the funding of transportation. RHODE ISLAND TAX RATE SCHEDULE 2021 CAUTION. However if Annual wages are more than 221800 Exemption is 0.

As a convenience tables for. We last updated Rhode Island Tax Tables in January 2022 from the Rhode Island Division of Taxation. Form RI-1040 is the general income tax return for Rhode Island residents.

How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table. This form is for income earned in tax year. If you still need to file a return for a previous tax year find the Rhode Island tax forms below.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the. More about the Rhode Island Tax Tables Individual Income Tax TY 2021. 2022 Child Tax Rebate Program.

Rhode Island standard deduction amounts by tax year Filing status 2021 2022 Single 9050 9 300 Married filing jointly 18100 18 6 00. This means that when both members of a married couple die only a single exemption of 1648611 applies. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per.

RI-1040 can be eFiled or a. This form is for income earned in tax year 2021 with tax returns due in April 2022We. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income.

You can download or print current or past-year PDFs of. We last updated the Income Tax Tables in January 2022 so this is the latest version of Tax Tables fully updated for tax year 2021. More about the Rhode Island Tax Tables.

RHODE ISLAND TAX RATE SCHEDULE 2021 CAUTION. We last updated the Income Tax Tables in January 2022 so this is the latest version of Tax Tables fully updated. Detailed Rhode Island state income tax rates and brackets are available on.

Exemption Allowance 1000 x Number of Exemptions. Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing. The Rhode Island estate tax is not portable between spouses.

Apply the taxable income computed in step 5 to the following. DO NOT use to. Find your income exemptions.

2022 Rhode Island Sales Tax Table. The States per gallon motor fuel tax was 034 in FY 2022 and FY 2021. More about the Rhode Island Form 1040 Individual Income Tax Tax Return TY 2021.

Find your pretax deductions including 401K flexible account. We last updated Rhode Island Form IT-95 in March 2022 from the Rhode Island Division of Taxation. The Rhode Island income tax rate for tax year 2021 is progressive from a low of 375 to a high of 599.

The state income tax table can be found inside the Rhode Island. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum.

DO NOT use to.

Rhode Island Income Tax Rate And Ri Tax Brackets 2022 2023

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

General Sales Taxes And Gross Receipts Taxes Urban Institute

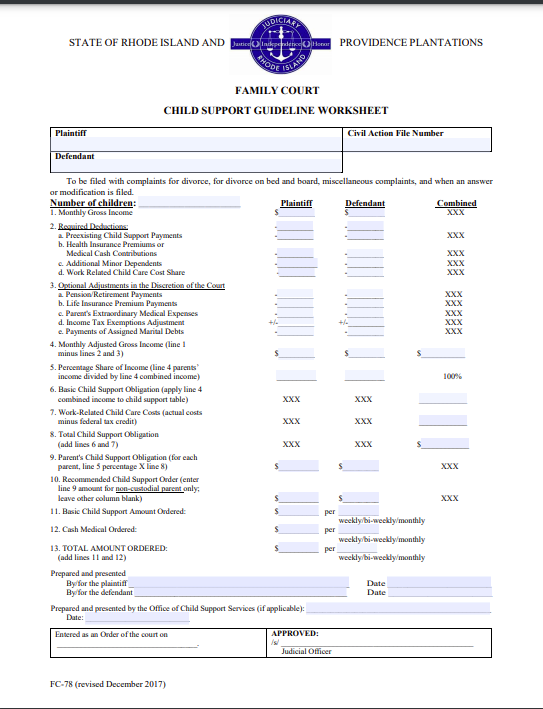

Rhode Island Child Support Laws Recording Law

Reopened Here S What Is Open In Rhode Island And Massachusetts Wpri Com

Covid 19 Tracking Charts Interactive Data Wpri Com

How To Become A Rhode Island Sole Proprietorship In 2022

Home Stop The Rhode Island Beverage Tax

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Rhode Island Division Of Taxation 2020

2021 Federal Tax Brackets Tax Rates Retirement Plans Western States Financial Western States Investments Corona Ca John Weyhgandt Financial Coach Advisor

Raising Revenues To Invest In Rhode Island Economic Progress Institute

Rhode Island Income Tax Brackets 2020

Rhodeislandtax Rhodeislandtax Twitter

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Rhode Island State Tax Software Preparation And E File On Freetaxusa